Key Highlights

- US faces wave of small-business failures this fall if federal government doesn’t provide new round of financial assistance

- Paycheck Protection Program (PPP) aid to small businesses no longer available

- Combination of expired PPP and expired weekly supplement to state jobless benefits could prolong recession, slow recovery and even reshape US business landscape

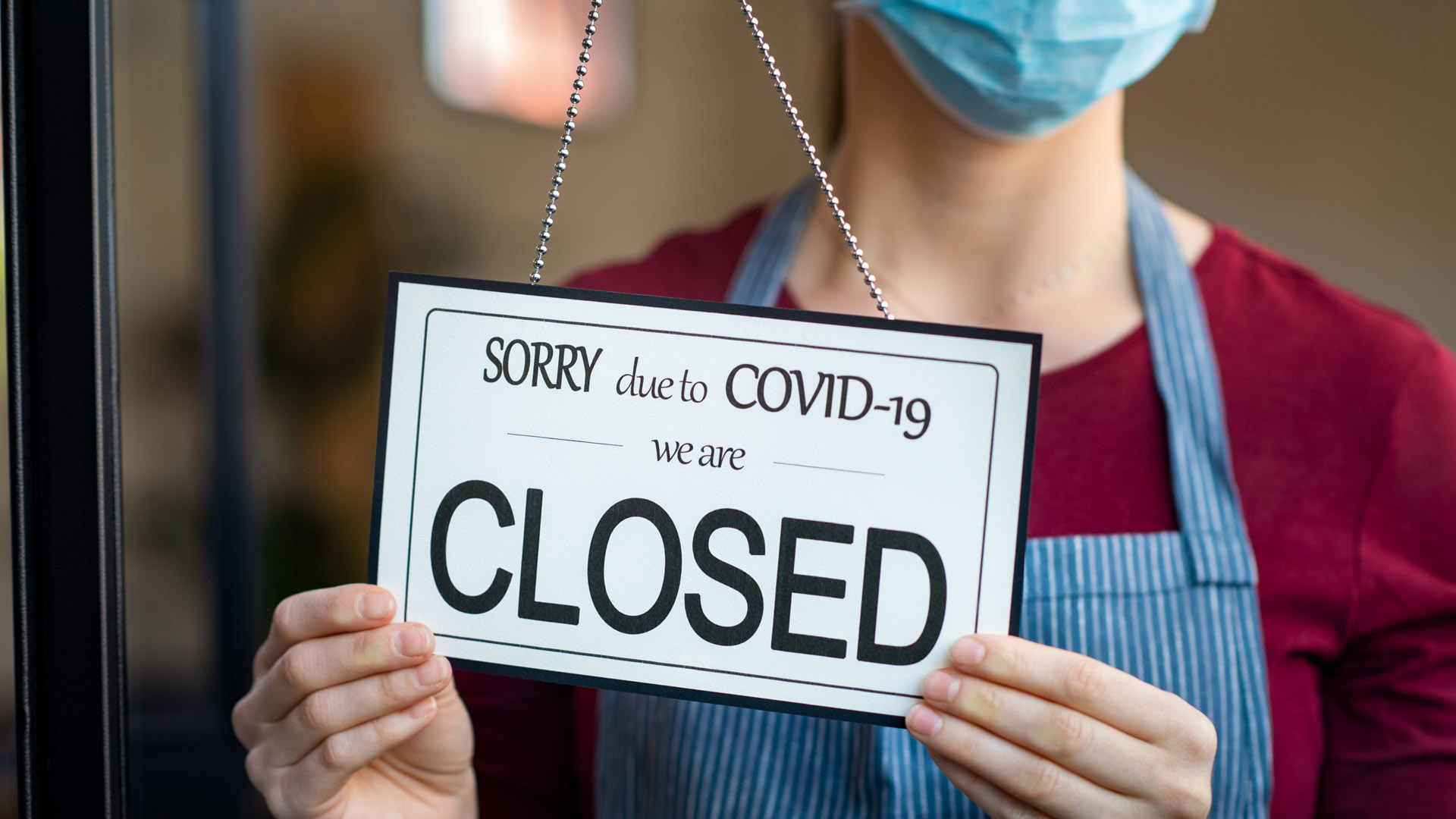

Could this fall be the season of multiple tsunamis in the US? A tsunami of small business closures due to expired financial assistance for small businesses? A tsunami of commercial vacancies as commercial tenants choose to lessen their corporate footprint and workers continue to work remotely? Another tsunami of unemployment claims if government assistance programs do not buoy businesses and their customers? Another tsunami of COVID cases and deaths if the fall/winter brings a resurgence of the coronavirus?

Download Your FREE Ultimate Agent Survival Guide Now. This is the exact ‘do this now’ info you need. Learn NOW How to Access All The Bailout Program Cash You Deserve. Including Unemployment and Mortgage Forbearance Plans. To Access the Ultimate Agent Survival Guide Now Text The Word SURVIVAL to 47372. 4 Msgs/Month. Reply STOP to cancel, HELP for help. Msg&data rates may apply. Terms & privacy: slkt.io/JWQt

We here at Tim and Julie Harris Real Estate Coaching have been focusing on unemployment claims but now that the Paycheck Protection Program (PPP) has expended its billions of dollars to help small businesses survive, it’s time to focus on “what if’s” for still-existing small businesses. (As you’ve no doubt noticed, tens of thousands of small businesses, restaurants, retailers and bars have already closed…some 20%, according to Homebase.)

Many businesses now face a very stark choice…Do they try to hold on through an uncertain winter with potential new shutdowns/restrictions with no guarantee that things will improve? Or, do they simply cut their losses in order to salvage whatever they can?

According to Markus Ripperger, president and chief executive of Hampshire House, the parent company to multiple restaurants/bars, “We’re on life support now, and if we have to go through another shutdown or more restrictions, it’s going to be even worse…”

The US Census Bureau indicated that about one third of small businesses surveyed in April said they expected conditions to take more than six months for overall business to return to normal. In its August survey, one half of small businesses said they expected it to take more than six months for things to return to normal and 7.5% said they don’t expect business to ever bounce back all the way. Roughly 5% expect to close permanently within the next 6 months.

The Commerce Department just reported that consumer spending rose just +1.9% m/m in July and that disposable personal income rose from -12.3% in June to +0.2% in July.

In a recent survey by the National Federation of Independent Businesses, 21% of small businesses indicated they would have to close in the next six months if conditions did not improve. Black-owned businesses, according to research by the Federal Reserve Bank of New York, have been and will continue to be more than twice as likely to close due to having less financial cushion and less likely to have established banking relationships that were critical when seeking loans under the PPP.

Many experts and business owners still look to Congress to reach a deal on economic assistance that would include aid to small businesses. Candace Combs, co-owner of a two-decade old business, looks around and sees boarded up storefronts but said, “I can survive because I’m betting on another stimulus package…without that, we start to really teeter.”

Thanks to The New York Times.

Also read: New Weekly Unemployment Claims Dip Below 1M for First Time in Five Months, New Yorkers and Tri-State Residents Leaving in Droves, Centers for Disease Control and Prevention via Trump Administration Halt Evictions Nationwide