Key Highlights

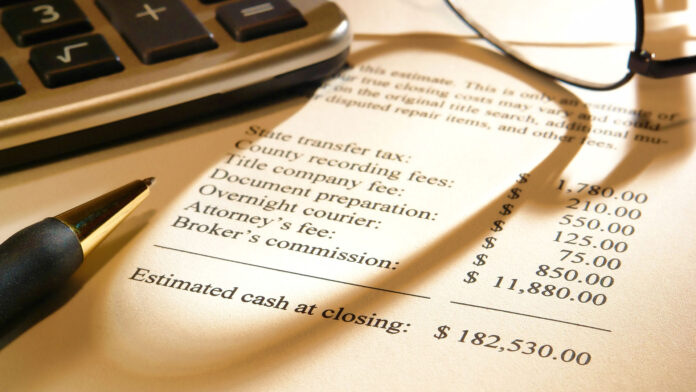

- Raw-profit and ROI figures from typical home sale during Q3 2020 at highest points since 2012

- Typical home sale generated $85,000, an increase of +38.6% compared to original purchase price

- Typical profit margins, percentage change between median purchase and resale prices, increased in 86% of US metro areas from Q3 2019 to Q3 2020

In another post summarizing findings in ATTOM data Solutions Q3 2020 US Home Sales Report just released, we indicated that a typical home sale during Q3 2020 generated a gain of $85,000 for homeowners in or a 38.6% gain in ROI compared with Q2 2020.

ATTOM’s Q3 2020 home sales analysis also indicated that the typical profit margins between median purchase and resale prices rose in 86% of metros areas, or 89 of 103 metros, with at least 1,000 single-family and condo sales compared to Q3 2019.

The West had the largest profit margins in the country with 14 of the top 15 typical home-sale ROI in Q3 2020. The leaders of those metros included:

- San Jose CA – 89% return

Salem OR – 73.9% return - Seattle WA – 73% return

- Spokane WA 70.3% return

- Salt Lake City UT – 65.1% return

Metros with the biggest annual increases in profit margins included:

- St. Louis MO – margins up from 22.4% to 37.1%

- Columbus OH – up from 37.1% to 51.6%

- Salem Or – up from 60.6% to 73.9%

- Indianapolis IN – up from 32.7% to 46%

- Akron OH – up from 20.7% to 33.7%

Metros with the greatest home-seller dollar gains included:

- San Jose-Sunnyvale-Santa Clara – $565,000

- San Francisco-Oakland-Hayward – $375,500

- Los Angeles-Long Beach-Anaheim – $254,00

- Seattle-Tacoma-Bellevue WA – $230,000

- San Diego-Carlsbad – $219,250

ATTOM ‘s Q3 US Home Sales Report also indicated that every major metro area saw home values rise. Metros with the biggest y/y increases in median home prices included:

- Bridgeport CT – +29.7%

- Detroit MI – +27.4%

- New Haven CT – +20.1%

- Birmingham AL – +19.7%

- Indianapolis IN – +19.3%

Thanks to ATTOM Data Solutions.

Also read: eXp World Holdings Q3 2019 – Major Gains & Narrowing Losses, September Set Records for Price, Sales, New Listings & Speed, Cities with Greatest Annual Home Seller Gains in Q2 2020