Key Highlights

- Profit margins hit new highs in midst of pandemic economy

- Median home prices rise in every major market

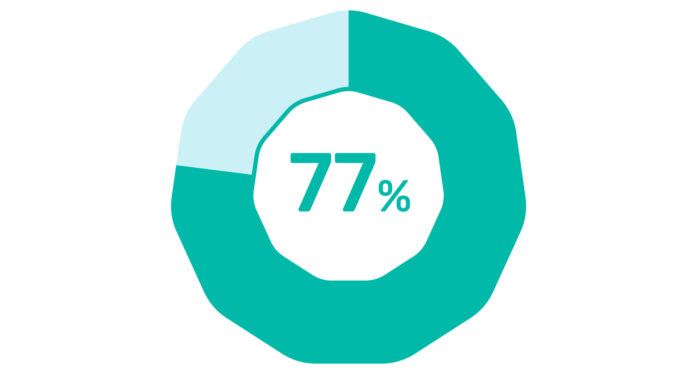

ATTOM Data Solutions Q3 2020 US Home Sales Report indicates that the typical home sold in Q3 2020 generated a gain of $85,000, up from $75,000 in Q2 and $66,000 in Q3 2019. This gain of $85,000 represents a +38.6% return on investment (ROI) compared to the home’s original purchase price. In Q2 2020, the ROI was +37.7% and in Q3 2019, the ROI was +33.7%.

This kind of gain and ROI percentage figure is at the highest level since the economic recovery from the Great Recession in 2012.

According to Todd Teta, chief product officer at ATTOM Data Solutions, “Home prices and seller profits across the nation continue racking up new highs as the housing market remains relatively immune from the economic havoc cause by the coronavirus pandemic. It’s almost as if the housing market and the overall economy are operating in different worlds. Things remain in flux (due to the ongoing-ness of the pandemic)…but with mortgage rates at rock-bottom levels and declining supplies of homes for sale, conditions remain in place for continued strong prices and returns.”

We’ll break down the specific metros where median home prices during Q3 2020 rose the most and where those y/y increases were the smallest, according to ATTOM, in another post.

Also, pay attention to these data points:

- Homeownership tenure hit 8.13 years, a new high nationwide since 2000, up from 7.76 in Q2 2020 and from 7.91 years in Q3 2019

- Cash sales hit the second lowest level since 2007 and accounted for just 21.6% of single-family home and condo sales in Q3 2020. For comparison, cash sales hit 24% of residential sales in Q3 2019.

- US distressed sales accounted for 7.2% of all single-family and condo sales in Q3 2020, down from 8.1% in Q2 2020 and from 9.8% in Q3 2019. This latest 7.2% of all residential sales is the lowest point of distressed sales since Q3 2005 and less than one-sixth of the peak level of 45.2% in Q1 2009.

- Institutional investing also remained low in Q3 2020 at just 1.7% of all residential sales. This 1.7% represented one tenth of one percent up from a 20-year low of 1.6% in Q2 2020 and down from 3.4% in Q4 2019.

Thanks to ATTOM Data Solutions.

Also read: Where iBuyers Sold the Most in Q3 2019, Buyers Market in NYC for Two-Bedroom Units, eXp Realty Doubles Sales Volume in Q3 2020