Key Highlights

- Households doing better than expected despite devastation from pandemic economy

- Big purchases on hold and spending scaled down for time being

- Longer-term consequences could linger for decades

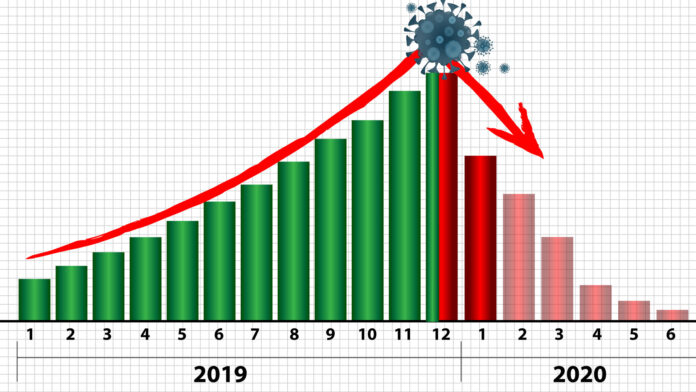

Just as the lockdowns and pandemic economy have been silver linings for the housing industry, this recession has several silver linings for many American households. Wha, you might askt? Am I reading correctly?

Lockdowns have translated into no or little spending on former “staples” such as vacations, restaurants, ballgames, musical events, etc. and many have held off making big purchases “just in case.” Mortgage lenders, student loan collectors and other creditors have offered breaks on payments, money that banks set aside for expected losses are basically untouched and even pawn shops and payday lenders have seen their businesses slow by more than -40% compared with last year, according to Veritec Solutions.

Yes…credit scores are up to a record average high of 711, personal savings rates soared to a cumulative $6.4T in April but has since declined, according to the Bureau of Economic Analysis, credit card balances plunged by $76B in Q2, according to the Federal Reserve Bank, and credit card spending plunged by $76B in Q2, the largest drop every recorded by the Federal Reserve Bank of New York.

Simultaneous with these silver linings, dark clouds are looming. Banks and other lenders are bracing themselves for forbearances to become foreclosures, millions remain jobless, the labor market’s rebound is stalling, COVID cases are surging, and the number of people living in poverty has increased by 8M since May.

One HUGE looming dark cloud consist of the massive evictions set to hit rental markets as rental debt surpasses $7B. Plus, CDC eviction moratoria are currently set to expire December 31. Moody’s Analytics told the Wall Street Journal that without another coronavirus stimulus package before the end of this year, outstanding rent debt could spiral up to $70B and a housing crisis could easily rival the housing crisis experienced 13 years ago.

Yes…longer-term economic consequences such as wage stagnation, thousands of shuttered small businesses and the cost of accumulated interest-bearing debt may darken those silver linings and last a long, long time.

Thanks to The New York Times, InmanNews, Wall Street Journal and Moody’s Analytics.

Also read: Could Another National Lockdown Be the Economy’s Best Hope?, America to Struggle More with Economic Disparities After COVID-19 Subsides, Lenders Bracing for Biggest Wave of Delinquencies in History