Key Highlights

- During first half of 2020, home prices increased +6.3%, according to Radian Home Price Index

- From July 2019 to June 2020, home prices increased +8.1% y/y

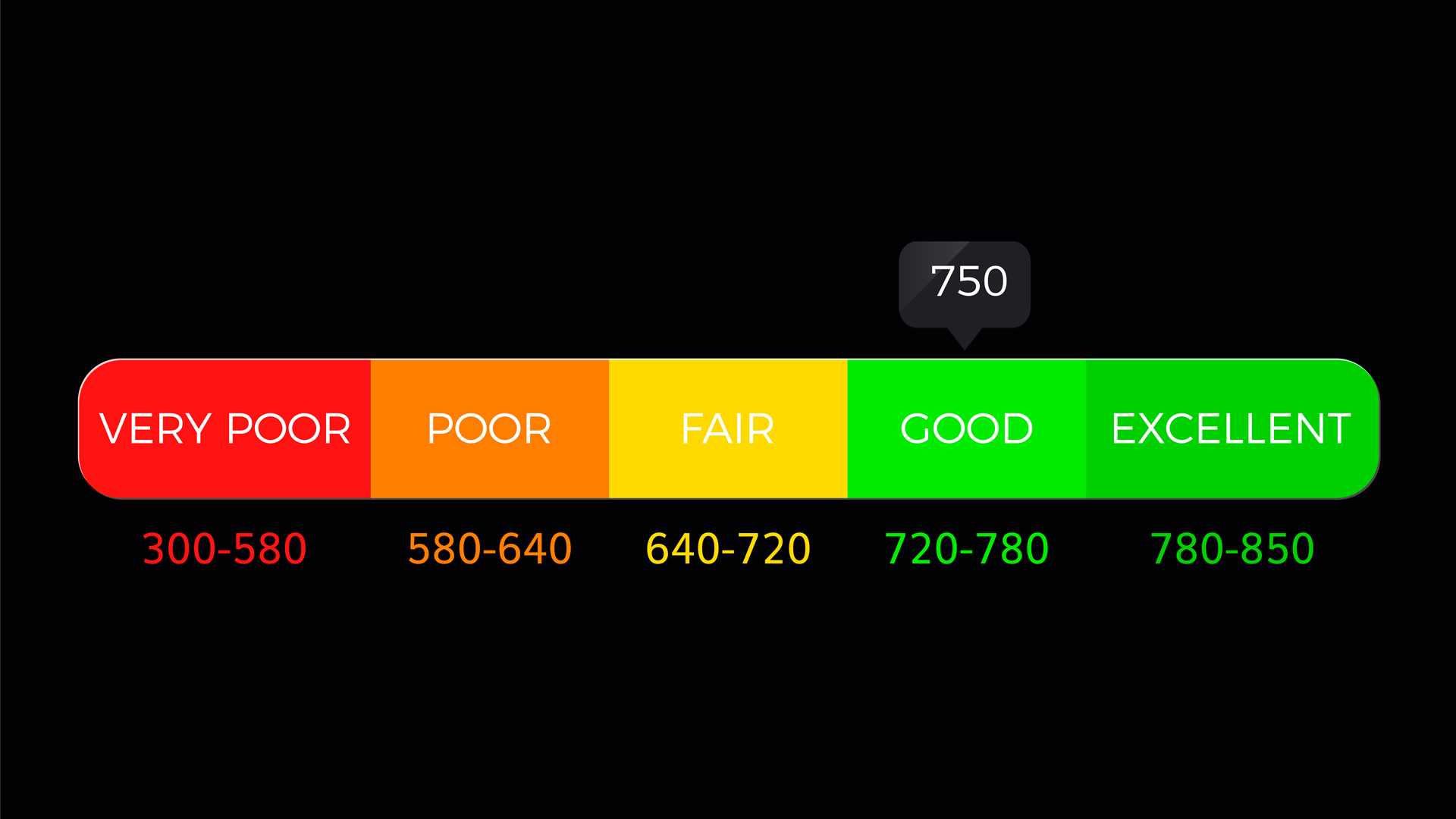

- Average FICO scores increased to 751 in June from 750 in May

The Radian Home Price Index substantiated the general upward trend in annualized yearly home price gains by posting an increase of +8.1% y/y from July 2019 to June 2020. During the first sic months of 2020, the Radian Home Price Index posted an increase of +6.3% in home prices nationwide.

Download Your FREE Ultimate Agent Survival Guide Now. This is the exact ‘do this now’ info you need. Learn NOW How to Access All The Bailout Program Cash You Deserve. Including Unemployment and Mortgage Forbearance Plans. To Access the Ultimate Agent Survival Guide Now Text The Word SURVIVAL to 47372. 4 Msgs/Month. Reply STOP to cancel, HELP for help. Msg&data rates may apply. Terms & privacy: slkt.io/JWQt

Radian’s data indicated that all of the 20 largest metros in the US posted positive price appreciation in both Q2 and the first half of 2020. In June, the median home price in the US was $256,740 rising to an annualized +6.6^ increase during Q2.

Midwest homebuyers found the highest rates of home price appreciation. Indiana, Minnesota and Missouri markets were strongest while Illinois was the weakest performing state in the region concerning home price appreciation.

Utah and Washington led the western region of the country in home price appreciation. California, likely due to already sky-high valuations, performed better than Hawaii, Nevada and Wyoming in this region of the country.

Home price appreciation rates in the south were mixed though Tennessee and Georgia recorded the strongest rates. Louisiana home price appreciation remained unchanged since the beginning of 2020 and Florida appreciation rates were the weakest.

Radian recorded strong home-price momentum in New Hampshire and Maine while the entire Northeast region recorded the slowest rate of home price appreciation during the first have of the year.

Home price appreciation rates in Q2 improved among 14 of the 20 largest metros in the country. The laggard metros in the first half of the year included Baltimore, Washington DC, Boston and Miami with increases ranging from +3% to +3.3%.

Steve Gaenzler, senior vice president of data and analytics with Radian, said, “While there has be localized volatility in home prices during the pandemic, prices overall have remained quite resilient. After gains across the US slowed in May, the first half of the year ended on an impressive note, especially given the significant headwinds real estate transactions have faced.”

Ellie Mae’s Origination Insight Report for June indicated that average FICO scores on all closed loans increased one point to 751 points in June from 750 points in May.

Jonathan Corr, President and CEO at Ellie Mae, said, “Homebuyers are taking advantage of historically low rates to both buy and refinance but it does appear that lenders are looking for borrowers with better credit across all mortgage products as FICO scores have continued to increase across the board since March.”

Thanks to Radian Home Price Index, Ellie Mae and HousingWire.

Also read: Renovate-to-Rent Fueling Foreclosure Auctions & Rental Rates Exploding, 2019 – “A Great Year To Be a Seller”, Idaho #1 in Home Price Appreciation

![Power Buyer Players – Part II [Real Estate Training]](https://timandjulieharris.com/wp-content/uploads/2021/12/Power-Buyer-Players-Part-II-Real-Estate-Training-100x70.jpg)