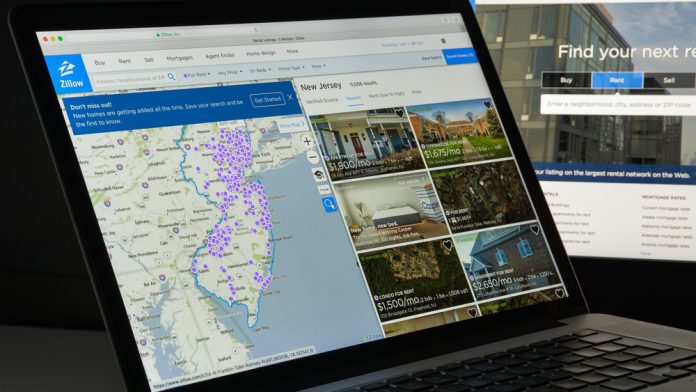

In 2017, it is taking longer than it used to in order to reach the break-even point on a home. In a new report, Zillow found that it takes about two years to live in a home before it makes more financial sense to buy over renting.

As property values rise around the nation, this has hampered owners’ ability to recoup the increasing upfront purchase prices and down payments, according to Zillow.

Breaking even is most difficult in the largest U.S. metro areas. It takes the longest to break even on a home purchase in large California markets. In San Jose, San Francisco, Los Angeles and San Diego, the Breakeven Horizon is at least four years.

In prosperous tech cities like Seattle, Portland and Dallas, homeowners enjoy the highest year-over-year home value appreciation among the 35 largest metro areas in the country. In Portland, home values rose almost 15 percent to a median value of $342,100. Home values in Dallas and Seattle appreciated 12 and 11 percent, respectively.

On the opposite end of the scale, buyers will break even fastest in the South and Midwest. In Indianapolis, Orlando, Detroit, Atlanta, and Tampa, it takes less than 1.5 years to break even on a home.

“There are many factors that go into the decision on whether to rent or buy,” said Zillow Chief Economist Dr. Svenja Gudell. “It’s also helpful for buyers to understand that as home value appreciation moderates, it will take them longer to break even than in past years.”

Overall, U.S. home value growth accelerated at the end of 2016, ending the year at a 6.8 percent annual appreciation rate. At the same time, rent appreciation slowed significantly, only growing at 1.5 percent annually. These shifting dynamics can make the question of whether to buy or rent less clear in many markets.

Home equity accumulates faster when home values grow quickly. However, that is not the case for expensive areas such as Silicon Valley and the San Francisco Bay Area, where home value appreciation is slowing down.

Supply and demand continues to be a key driver for home values and appreciation. According to the Zillow survey, there are 4.6 percent fewer available homes than there were a year ago. Among the nation’s largest markets, Boston and Minneapolis saw the biggest declines in inventory over the past year.

According to Pro Teck Valuation Services’ Home Value Forecast for December 2016, residential housing supply has declined by 125 percent in two years.

“We’ve written about it often — how the drop in housing starts post-crisis made inventory scarce, which as a result led to low Months of Remaining Inventory (MRI) and fierce competition for homes on the market,” said Tom O’Grady, CEO of Pro Teck Valuation Services.

Housing starts in 2016 set their best pace in nearly a decade, though the annual rate of single-family housing starts declined by 4 percent in December down to 795,000, according to the latest data from U.S. Census Bureau.

“Even with stronger home construction in recent years, more increases in the supply of new homes will be needed to balance out the market, reflected in rapid house price appreciation in recent years,” said David Berson, Chief Economist with Nationwide.

The National Association of Realtors also has indicated a drop in inventory in December, down to 1.65 million existing homes for sale (lowest since NAR began tracking the data in 1999) and has declined over-the-year for 19 straight months.

“Housing affordability for both buying and renting remains a pressing concern because of another year of insufficient home construction,” NAR Chief Economist Lawrence Yun said. “Given current population and economic growth trends, housing starts should be in the range of 1.5 million to 1.6 million completions and not stuck at recessionary levels.”

With several key trends converging, it is apparent that 2017 will be a seller’s market in real estate.