Real estate agents today are working in a hyper-competitive landscape with many clients interested in investing in property as a part of their financial portfolio. Amid low interest rates, clients looking for investments can find a greater yield, making the single family home an attractive option.

According to a CNBC report, they can provide your client with a steady income stream each month. According to Steve Hovland, director of research at HomeUnion, a real estate investment marketplace, as home prices continue to rise, the value of the initial investment increases as well. However, that isn’t stemming the tide of investors entering the fray.

“We are seeing more investors and new investors. The Fed has really been helping us out. Interest rates are not as high as they have been in past cycles. Commercial real estate is overheated. The bull stock market has been running for a long time, so investors are looking to diversify.”

Tim and Julie Harris recently talked to HomeUnion CEO Don Gaguly. Be sure to check out the podcast of that discussion.

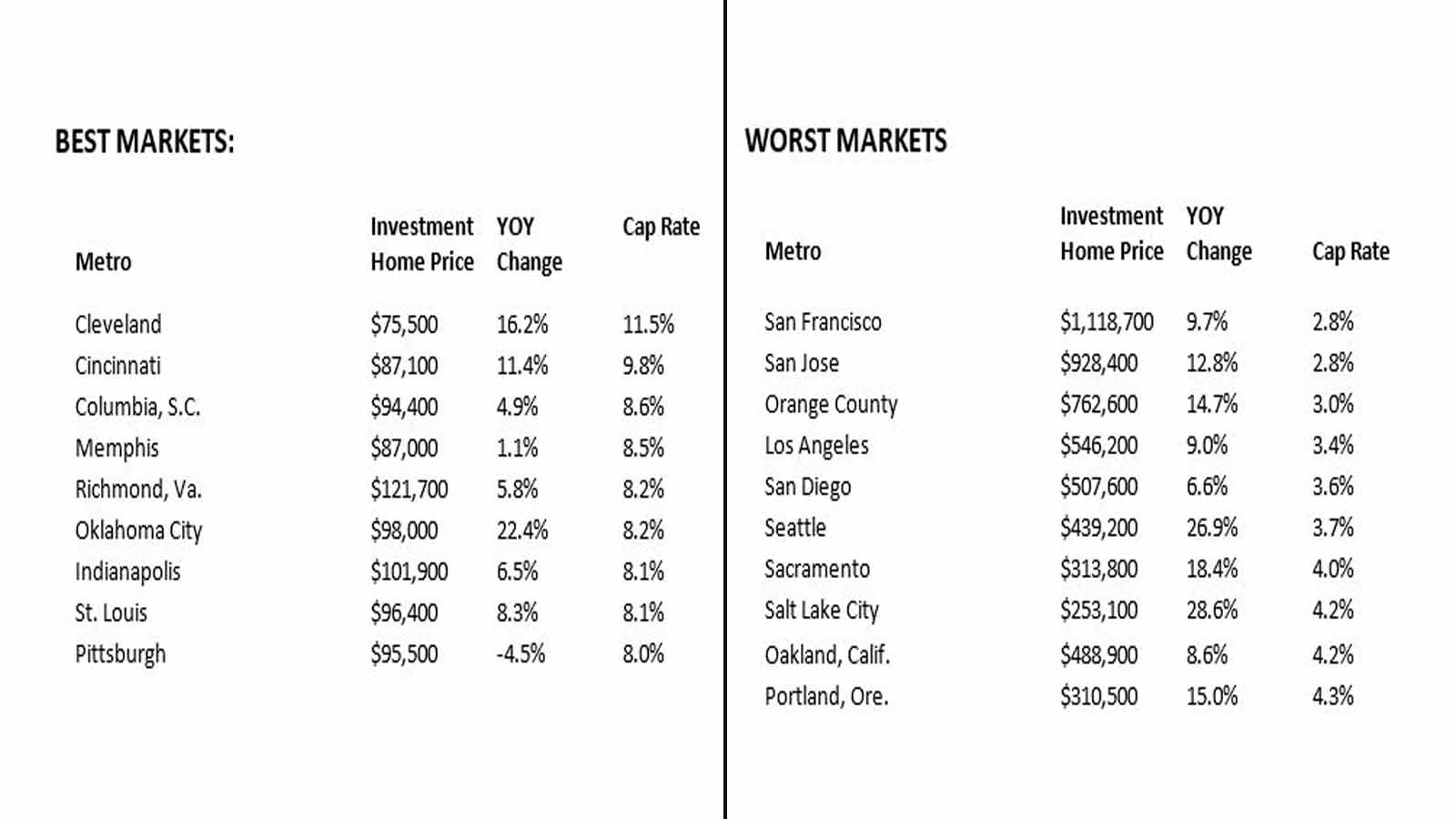

Agents are poised on the front lines as investment returns in real estate can vary by region. Your clients in markets where rents are high may not always get the biggest returns. HomeUnion recently ranked the 10 best and 10 worst markets for real estate investing in the first quarter of the year. Their rankings are based on first-year returns. According to the survey, the 10 best markets include Cleveland; Cincinnati; Columbia, S.C.; Memphis; Richmond, Va.; Oklahoma City; Indianapolis; St. Louis; and Pittsburgh.

Cleveland has an investment home price of $75,000, a year-over-year change of 16.2 percent and a capitalization rate of 11.5 percent, while at the bottom of the Top 10, Pittsburgh has an investment hope price of $95,000, a capitalization rate of 8 percent and a year-over-year change of -4.5 percent.

Seven of the 10 worst markets are in California. The bottom 10 includes San Francisco; San Jose; Orange County; Los Angeles; San Diego; Seattle; Sacramento; Salt Lake City, Utah; Oakland and Portland.

In San Francisco, the investment hope price average is $1.1 million, a year-over-year change of 9.7 percent and a capitalization rate of 2.8 percent. In Portland, the typical investment home costs $310,500, a year-over-year difference of 15 percent and a cap rate of 4.3 percent.

While regions may have differing prices, one constant is supply. Investors are always looking for entry-level homes and there are few to be had. Those that are in great condition are a hot commodity and usually get several officers. If investment activity is hot, your clients may face even more competition. Hoyland said moving quick is key.

“It makes it definitely harder. They have to act quickly. They have to be patient and understand that an investment property is not necessarily the only one that’s going to be out there. We lose a lot of bids. The market is hypercompetitive.”