Key Highlights

- CFPB issues final mortgage servicing regulations to help prevent “surprises” for borrowers exiting forbearance

- Mortgage servicers only allowed to initiate foreclosure action after borrower submits/rejects loss mitigation application

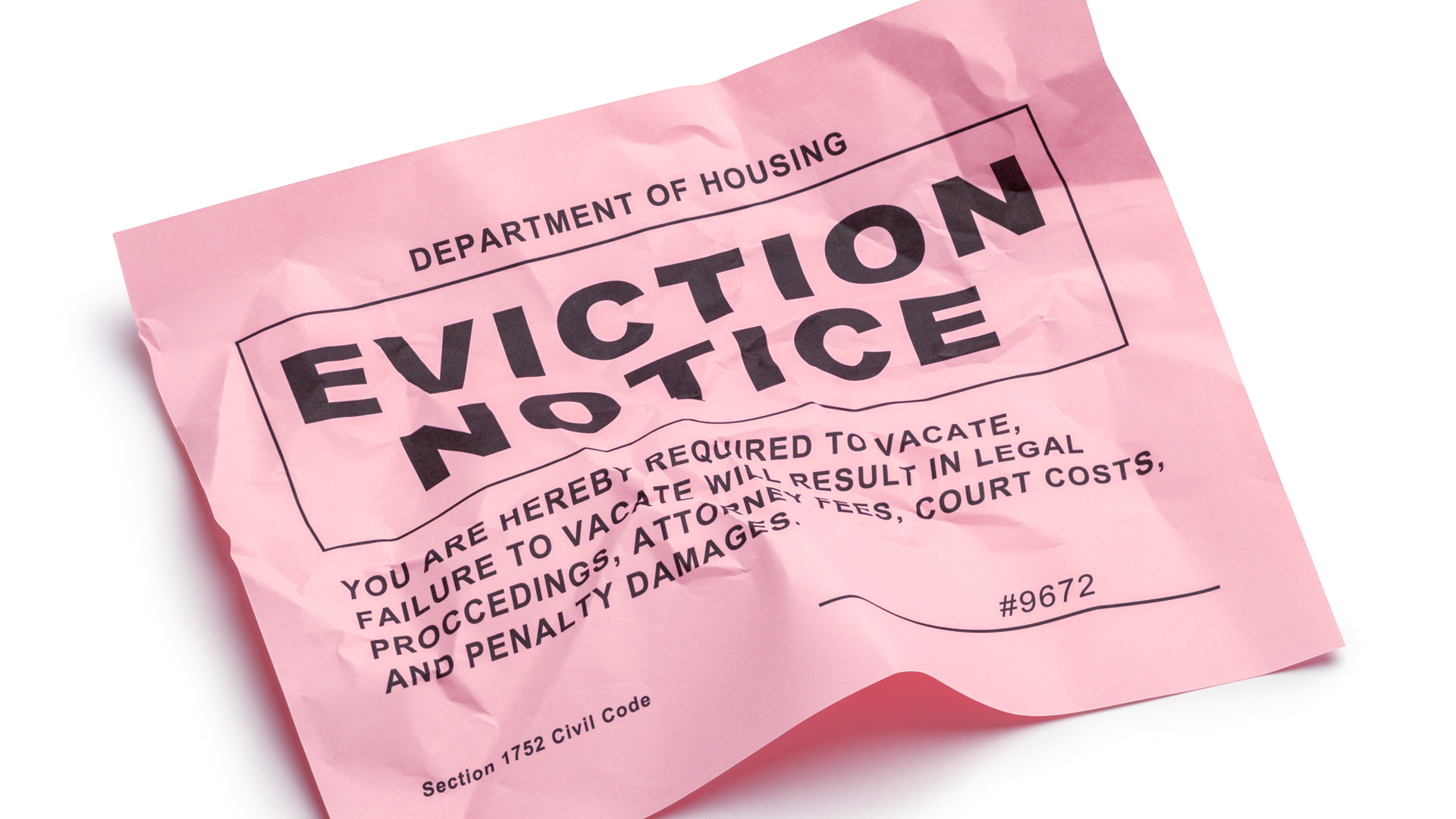

CFPB Lays Out Rules for Mortgage Servicers

The Consumer Financial Protection Bureau (CFPB) issued its final mortgage servicing regulations for mortgage servicers to follow as the moratorium on foreclosures is set to expire on September 1 2021.

Included in these regulations for mortgage servicers are:

- Servicers can initiate a foreclosure action ONLY after the borrower submits or rejects/breaks a loss mitigation application.

- Servicers can skip this requirement ONLY if the borrower was already past-due by March 2020 OR if the property has been abandoned

- Escrow shortages can be included in a loss mitigation option

- Servicers are limited to how much they can require borrowers to deposit in an escrow account through next year

- Servicers CAN offer streamlined loan modifications to borrowers as long as those modifications DO NOT increase monthly payments or stretch out the mortgage term beyond 40 years

- Servicers CANNOT charge extra fees for loan modifications

- Servicers MUST waive any late charges if the borrower accepts a loan modification

- Regulations indicate that financial hardship is to include any hardship indirectly or directly sparked by the pandemic from March 2020 to February 2021

CFPB Encourages Mortgage Servicers To Be “Proactive” Communicators with Borrowers

Dave Uejio, acting director of the CFPB, said, “We are giving homeowners the time and opportunity to make informed decisions about the best course of action for them and their families, whether that is seeing a loan modification or selling their house.”

Can the CFPB prevent every foreclosure? No. The CFPB indicated that “some foreclosures are unavoidable.”

Borrowers who were already six months behind on their mortgage payments pre-pandemic are at particular risk of foreclosure.

Regulations Meant to Ease Transition of Exiting from Forbearance

Diane Thompson, senior advisor to the acting director of the SFPB, said, “This work is done in concert by work with other federal agencies, all actively in the process of figuring out what better options there are for people as they exit forbearance plans. (These regulations) give people a bridge to get into those loan modifications and figure out what the best path forward for them and their families is.”

Thanks to the Financial Times and HousingWire.

URGENT: 2021 Results Released. New FREE On-Line Web Event Reveals 17 Surprising Secrets Of The Top 100 Millionaire Agents. Get Your FREE Spot For The On-Line Webinar Now. When You Attend This Event You Will Have A Sense Of Relief Knowing You Can FINALLY Laugh At Your Money Worries – If You Follow This Simple Plan. Learn How To Generate 100’s of Motivated Leads Without Coming Off As A Pushy Salesperson and Losing Your Soul. Learn Now How To Become One of the 1000s of Agents Making HUGE Money NOW Who Never Thought They Could.

P.S. Limited Space Available. 235 Spots Left.